Did you know that owning certain dogs can raise your home insurance rates—or even get you denied coverage? Many pet owners are surprised by these restrictions.

Insurers often classify some breeds as high-risk based on past claims and liability concerns. But what factors influence these decisions?

The list of excluded breeds varies, but the reasoning is similar: concerns over size, strength, and historical bite reports. Yet, not all policies apply the same rules.

If you’re a dog owner, understanding these policies is crucial. It can affect your home insurance costs and even your ability to get coverage.

Let’s explore why insurers blacklist certain breeds and what options you have if your dog is on the list.

7 Dog Breeds That Insurance Won’t Cover

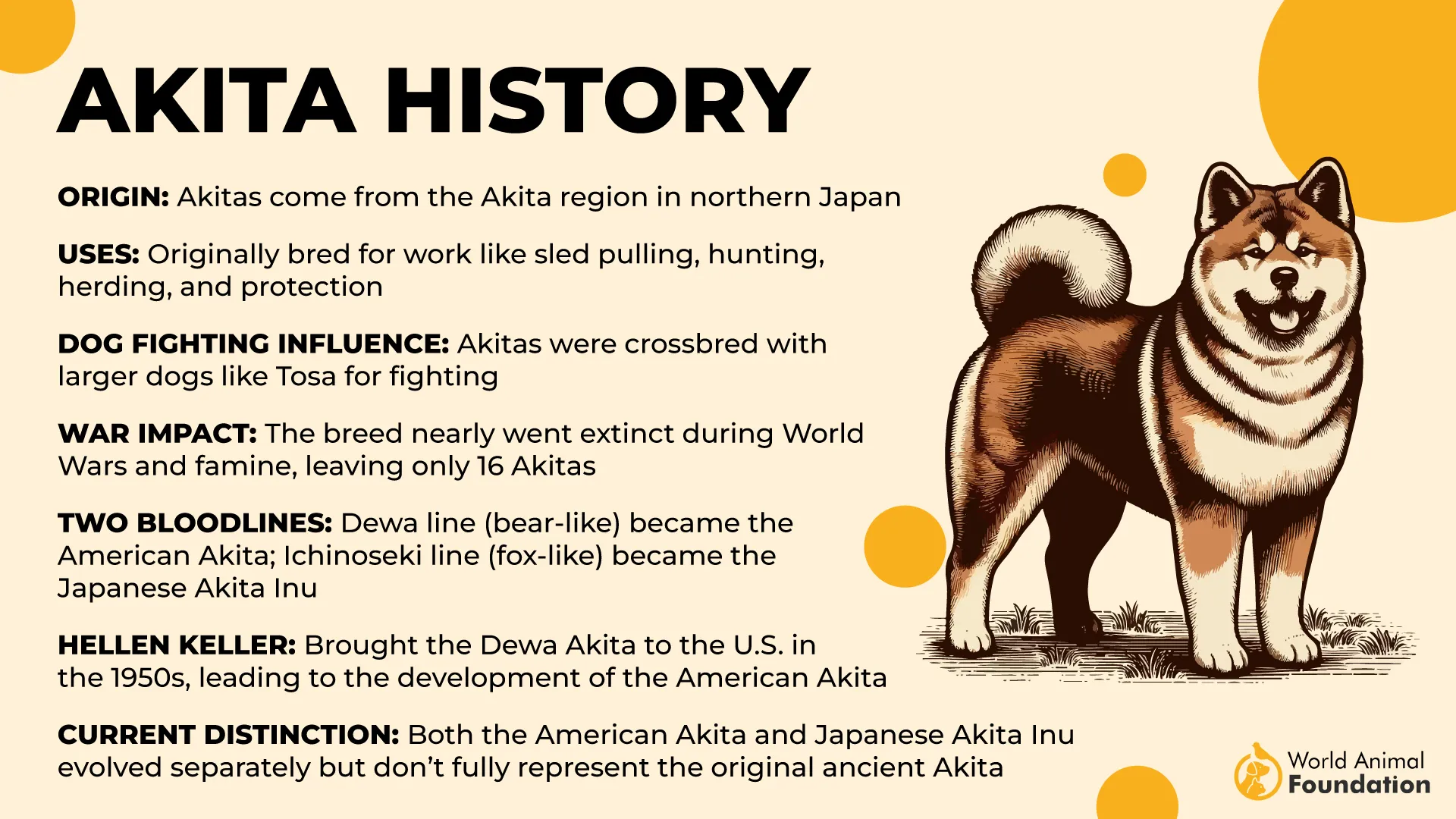

1. Akita

Loyal and dignified, the Akita is a powerhouse wrapped in fur. Originally bred in Japan to hunt wild boar and bears, this very large dog boasts strength and an independent streak that can challenge even experienced owners.

Home insurance providers aren’t big fans. Akitas have a history of being territorial, which translates to breed restrictions and coverage denials. Many insurers place them on dog breeds’ banned lists due to concerns over aggression.

AKC explains that despite their regal appearance, Akitas require serious obedience training and early socialization. Without it, they may develop guarding instincts that make them wary of strangers and other dogs.

This breed thrives on routine and mental stimulation. Daily training, structured walks, and controlled interactions help manage their physical strength and prevent unpredictable behavior.

They aren’t the most vocal dogs, but when they bark, it matters. Training can help curb excessive alerts while reinforcing confidence and control.

If an Akita bites, the damage can be severe, leading to expensive liability claims. Investing in canine liability policies and responsible ownership is a must for keeping both your pet and your homeowner’s insurance policy intact.

Want to keep your Akita insured? Some home insurance companies offer coverage based on an individual dog’s history, so a well-trained Akita with a Canine Good Citizen certification may stand a better chance.

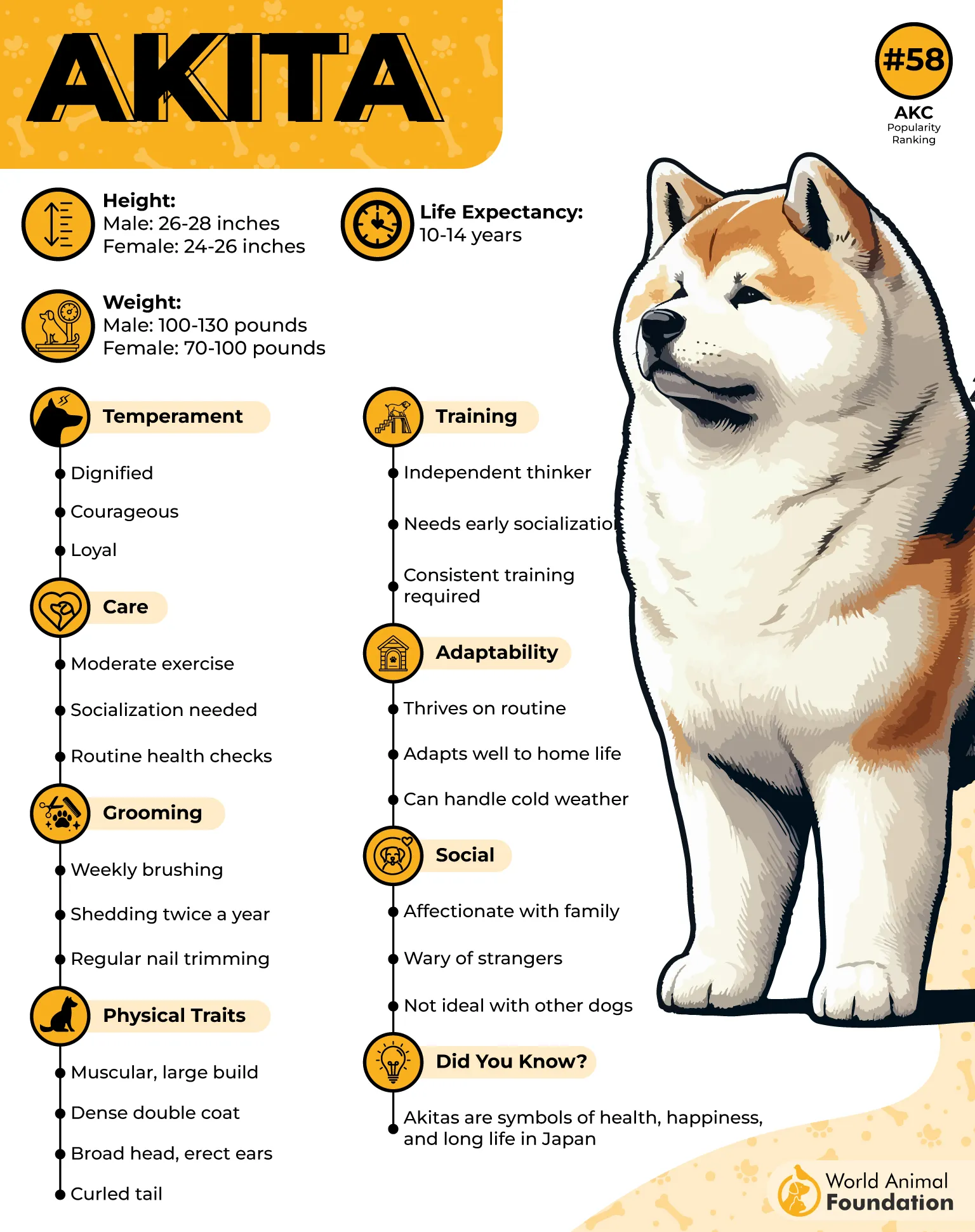

2. Alaskan Malamute

A fluffy sled dog with a work ethic that could put most of us to shame, the Alaskan Malamute was originally bred to haul heavy loads in Arctic conditions. This very large dog is powerful, independent, and bursting with energy.

But for home insurance companies, that’s not necessarily a good thing. Their high prey drive and stubborn nature put them on restricted breed lists, especially if they lack proper training and early socialization.

Malamutes don’t just play rough—they live rough. Without enough exercise and mental stimulation, they can become destructive. Think of chewed-up furniture and holes the size of craters in your yard.

They aren’t aggressive by nature, but their size and strength mean they can accidentally cause property damage or injuries, leading to liability claims related to dog ownership.

Socialization is key. Exposing them to other dogs and smaller animals from a young age helps curb their natural instincts.

Their wolf-like howls might sound cool—until your neighbors start filing noise complaints. Training and interactive play can help channel their energy productively.

Some insurance providers may offer coverage options if your Malamute has no bite history and has completed obedience training. Still, many home insurers remain cautious with this breed.

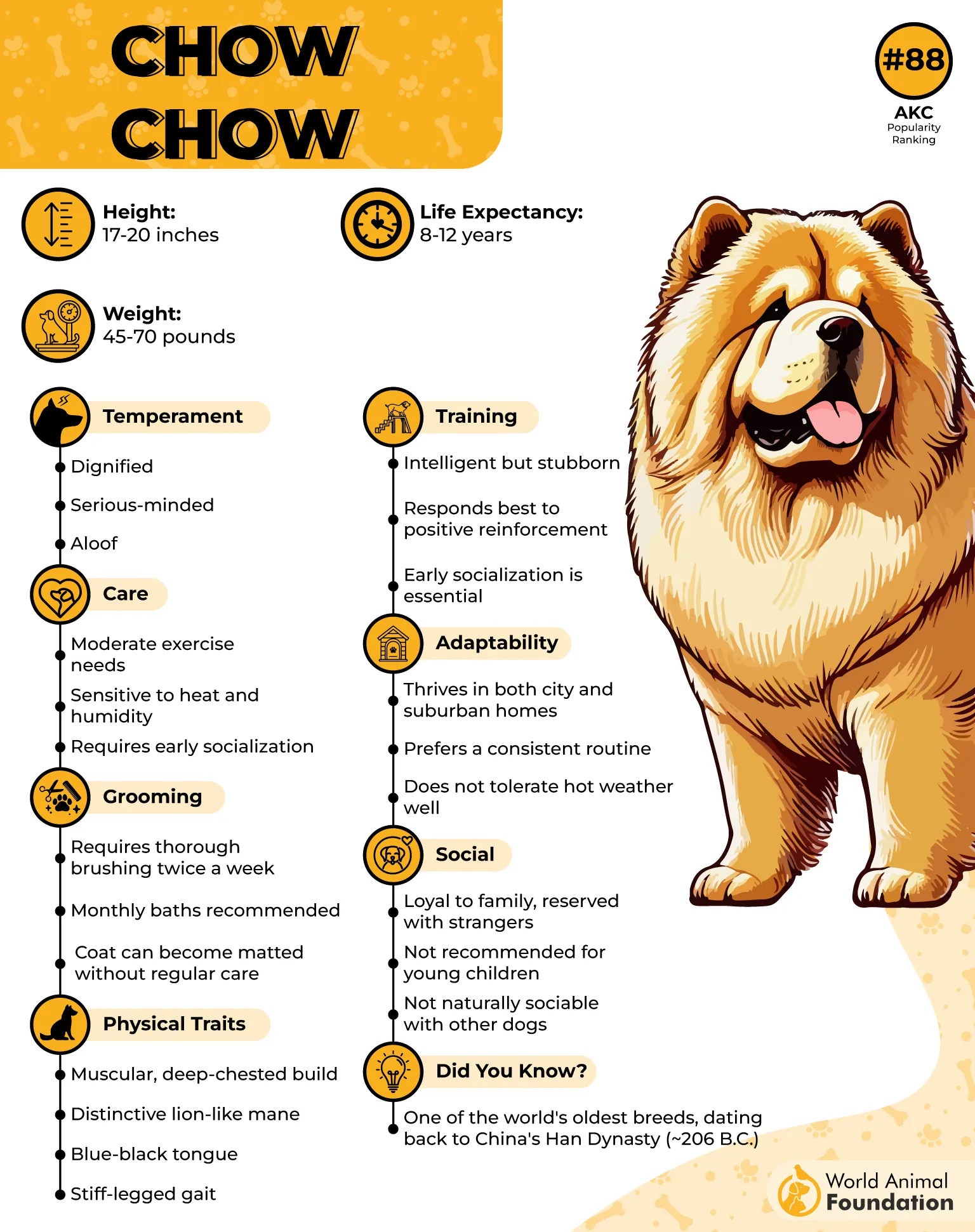

3. Chow Chow

Dignified, fluffy, and secretly judgmental, the Chow Chow is a breed with ancient roots. But despite their regal appearance, they aren’t known for being the friendliest dogs on the block.

That’s a problem for homeowners insurance companies. Chows have a reputation for being aloof and territorial, which lands them on many breed restrictions lists. Insurance providers consider them a high-risk breed due to their tendency to react aggressively when provoked.

Chows don’t appreciate surprises—whether it’s a stranger at the door or an unfamiliar other dog. Without early socialization, they can develop strong guarding instincts that make them unpredictable.

Despite their lion-like mane, they aren’t cuddly lap dogs. They tolerate their families but aren’t overly affectionate. If pushed too far, they have been known to lash out, leading to expensive liability claims.

Training a Chow requires patience. They aren’t eager to please like some other dog breeds, so consistency and positive reinforcement are crucial.

PDSA reveals that their stubborn nature, combined with a naturally aloof temperament, makes them a challenging breed for first-time owners. Home insurance policies often exclude them due to dog bite claims and liability coverage concerns.

If you’re set on owning a Chow, some home insurance companies may provide coverage based on your dog’s history—but expect higher premiums or the need for canine liability policies.

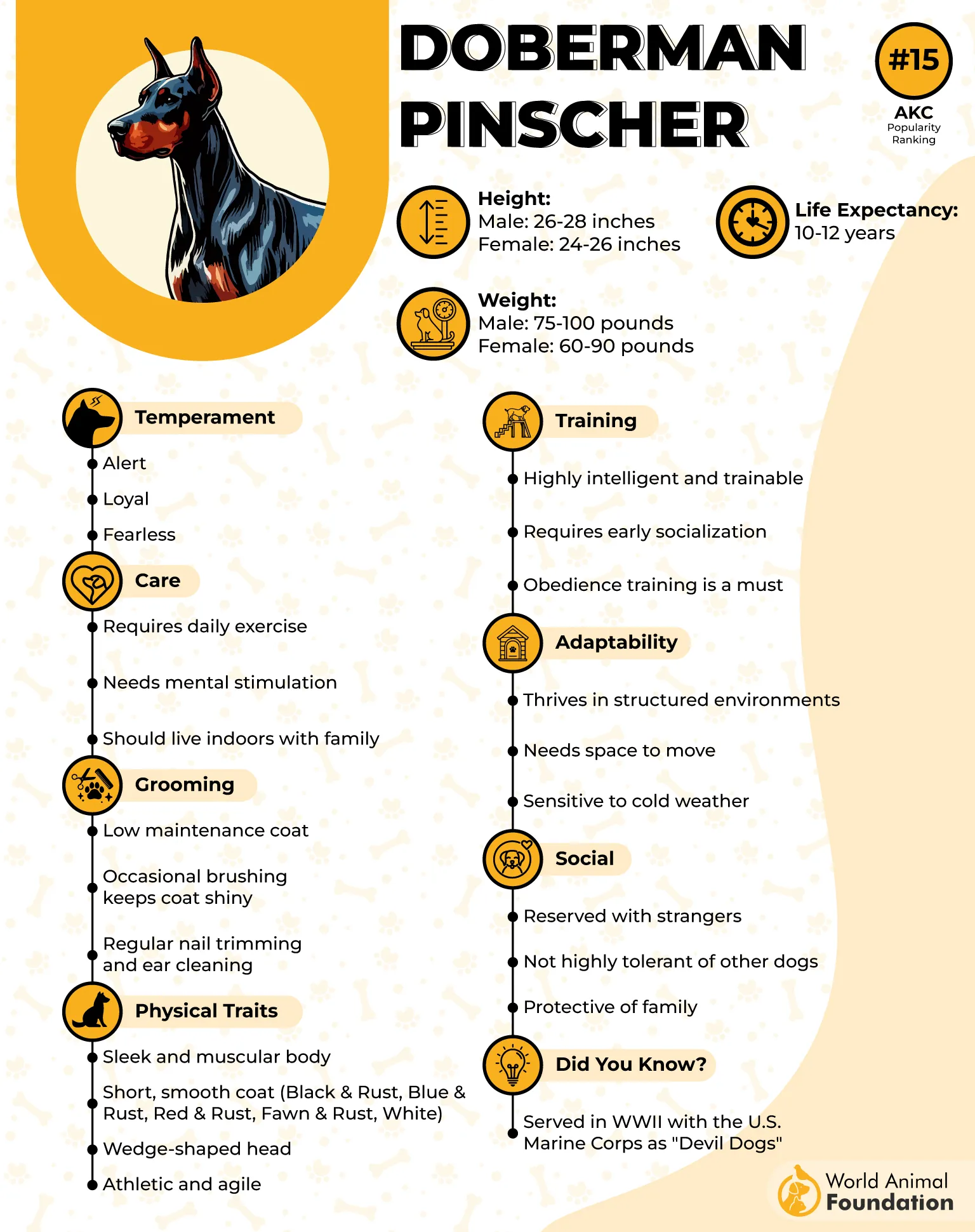

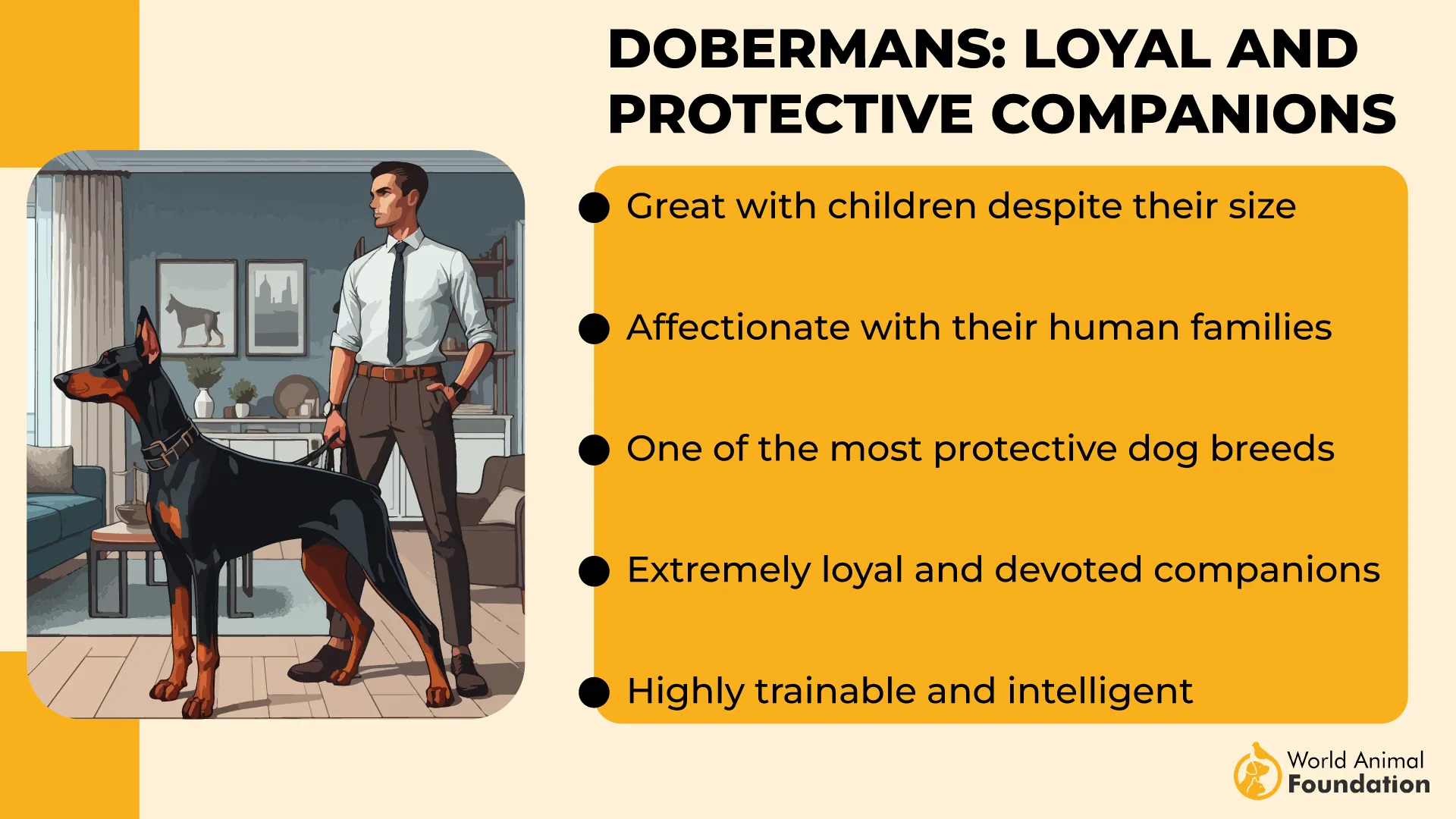

4. Doberman Pinscher

Sleek, intelligent, and fiercely loyal, the Doberman Pinscher was originally bred as a guard dog—and they take their job very seriously. With their protective instincts and imposing presence, they excel in personal protection, but that also puts them on many insurers’ breed lists.

Homeowners’ insurance providers frequently deny coverage for Dobermans due to their reputation as dangerous dogs. Their speed, strength, and strong bite force make them a liability in the eyes of insurance companies.

Proper obedience training and early socialization can make all the difference. A well-trained Doberman is highly disciplined, but without structure, they can become overprotective and territorial.

They need mental and physical stimulation—daily training, puzzle toys, and long exercise sessions are a must. A bored Doberman is a destructive one, which adds risk to home insurance policies.

While loyal to their families, they tend to be suspicious of strangers. Without the right leadership, their protective instincts can lead to dog bite claims and other dog-related injuries.

Despite the stigma, Dobermans can be wonderful companions with responsible ownership. Some home insurers will provide coverage if the dog has completed a Canine Good Citizen certification and has no bite history.

If your current insurer won’t cover your Doberman, looking into canine liability policies or pet insurance might be your best bet.

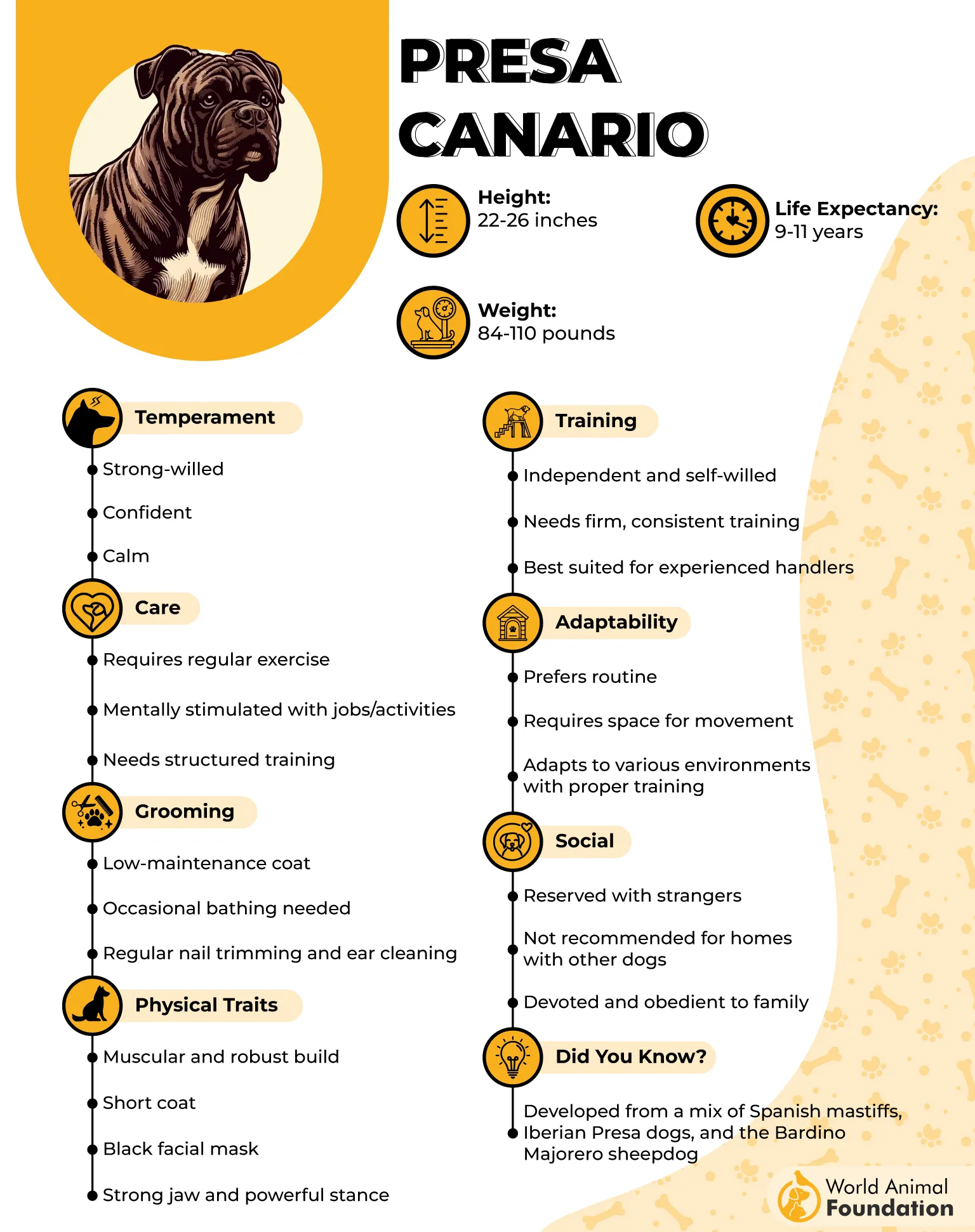

5. Presa Canario

Built like a tank and originally bred for working livestock, the Presa Canario (or Canary Dog) is not for the faint of heart. This very large dog has an intense guarding instinct, making them both loyal protectors and a liability in the eyes of insurance companies.

Many homeowners insurance providers refuse to provide coverage for this breed due to their physical strength and potential for dog attacks. Their sheer power makes them a risk, even for experienced owners.

Early obedience training is non-negotiable. Without it, their dominant nature can lead to behavioral issues, including aggression toward other dogs and unfamiliar people.

They require firm leadership and extensive early socialization to ensure they don’t become overly protective. Without proper structure, they can be unpredictable, adding risk to homeowners insurance policies.

CKC reports that Presa Canarios have an intense prey drive, making them a poor choice for homes with smaller animals. Their instincts can be difficult to control without constant reinforcement.

If a dog bite claim involves a Presa, the liability claims related to it can be costly. Many home insurers classify them as a restricted breed and won’t offer coverage.

For owners determined to keep one, canine liability policies and personal finance planning are essential, as many insurers won’t include them in standard home insurance policies.

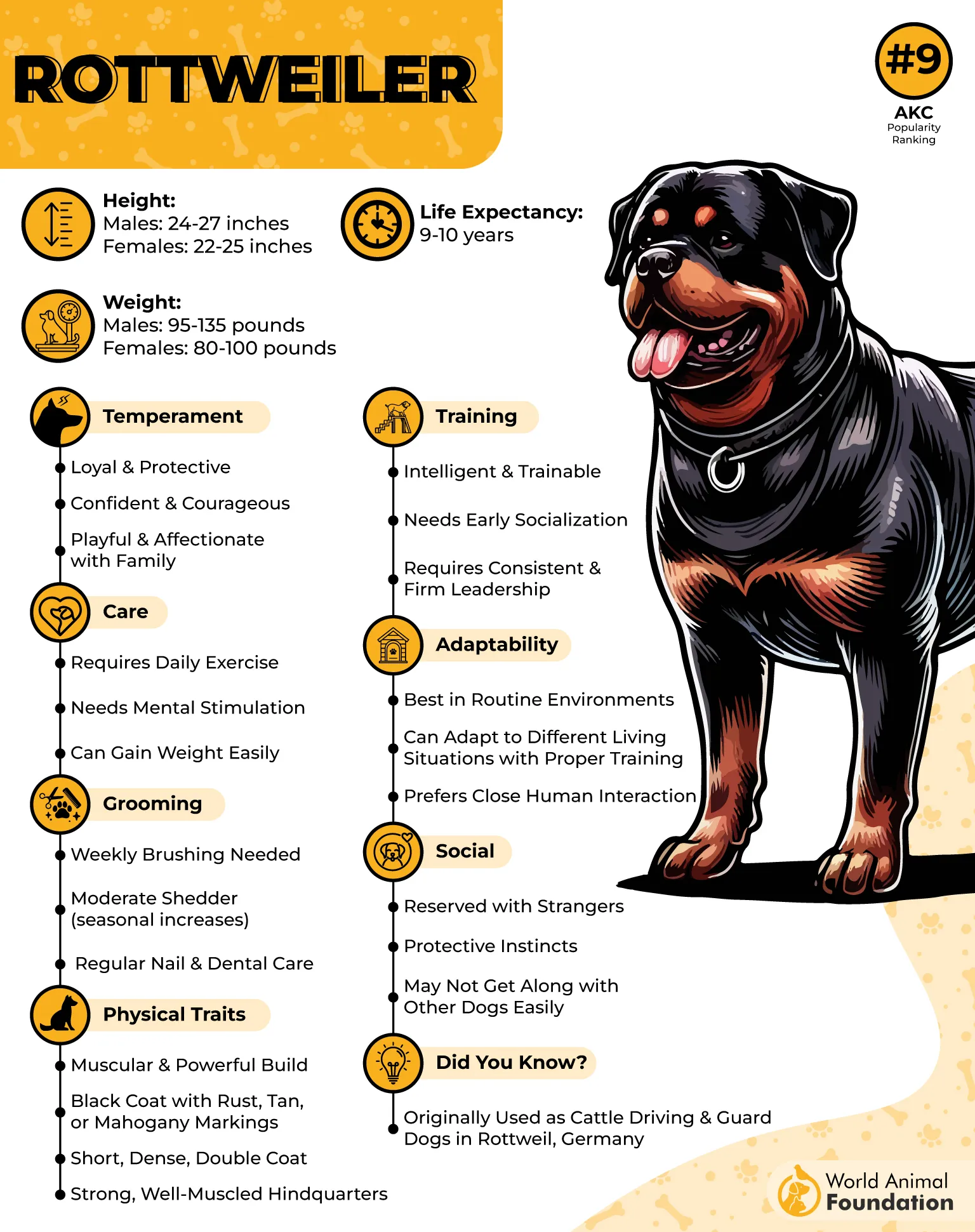

6. Rottweiler

Loyal, confident, and surprisingly affectionate with their families, Rottweilers are both guardians and gentle giants—when properly trained. But in the insurance world, they land on many breed restrictions lists.

Why? Their physical strength, protective instincts, and history of dog bite claims make homeowners insurance companies hesitant to provide coverage. Many view them as a dangerous dog, even though their temperament depends heavily on training.

Rottweilers thrive with obedience training and clear leadership. Without it, their natural guarding instincts can lead to liability claims related to aggression or territorial behavior.

Despite their reputation, well-trained Rotties are intelligent and eager to please. They need structured exercise and mental challenges to stay balanced.

Their bite history in dog liability insurance cases is a major concern for home insurers. Even a protective nip can lead to expensive liability claims.

A Canine Good Citizen certification can help sway an insurance provider, but some home insurance companies still refuse coverage. If denied, canine liability policies may be the only option.

Responsible ownership is key—Rottweilers are loving companions but require a strong, experienced hand to ensure they don’t end up on the wrong side of liability coverage.

7. Staffordshire Terrier

Strong, athletic, and misunderstood, the Staffordshire Terrier is often lumped in with other dog breeds under breed-specific legislation. Despite their loyal and affectionate nature, many home insurance companies classify them as a restricted breed.

Their muscular build and high energy levels make them look intimidating, but temperament-wise, they are playful and loving—when raised correctly. Unfortunately, their reputation leads to dog breeds banned policies from many insurers.

Early socialization and obedience training are critical. A well-trained Staffordshire Terrier is friendly and well-mannered, but without structure, they can develop protective behaviors that raise liability coverage concerns.

Purina adds that these dogs are strong-willed and require firm but positive training methods. A bored Staffy can be destructive, adding risk to homeowners insurance policies.

Despite their bad rap, they make excellent family dogs. However, due to past dog bite claims, homeowners insurance providers often exclude them from standard home insurance policies.

If your current insurer refuses coverage, canine liability policies or switching to a more flexible insurance provider may be necessary. Some companies may insure a Staffordshire Terrier based on their dog’s history and training certifications.

With the right ownership, these dogs can be loving companions—but expect challenges when navigating home insurance policies.

Conclusion

Owning a dog is all fun and games—until you realize homeowners insurance coverage might not be on your side. Certain dog breeds are labeled as considered high-risk, making it harder (or pricier) to get insured.

From the powerful Rottweiler to the headstrong Chow Chow, many of these specific dog breeds face bans due to past severe injuries and liability claims says the American Kennel Club (AKC). And if you think your Great Dane or Cane Corso gets a pass—think again.

Breeds like Pit Bulls, German Shepherds, and Siberian Huskies are often on restricted lists too. Even wolf hybrids and pit bull-type dogs are flagged as highly unpredictable by some home insurance policies.

So what can you do? Look for an insurance industry like State Farm that evaluates dogs on behavior, not breed. Check with the Insurance Information Institute for updates on breed restrictions.

Still stuck? Some owners turn to canine liability policies or shop for breed-friendly home insurance companies. Because let’s face it—no one wants their furry best friend labeled a risk.

What’s your experience with homeowners insurance and dogs? Drop a comment and let’s talk about how breed bans affect pet owners!